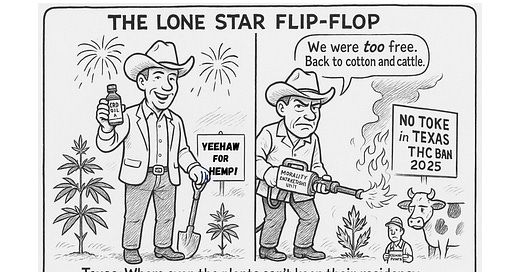

The Lone Star Flip Flop

"Texas: Where the only thing greener than hemp is the envy of moral crusaders."

The GOP’s War on Legal Hemp

Let’s be blunt: this ban is a betrayal of every Texan who trusted their government.

Republican lawmakers—many of whom celebrated the 2019 hemp bill as “free-market innovation”—have now pulled a 180. Why? Political pressure. Corporate influence. And maybe most of all, fear that cannabis reform is winning the culture war.

So instead of regulating responsibly, they dropped the hammer. The ban criminalizes products that are legal federally, safe when tested, and used daily by veterans, cancer patients, and ordinary Texans trying to sleep, manage pain, or de-stress without pharmaceuticals.

This Isn’t Governance—It’s Sabotage

Texans followed the law. They launched businesses. They hired staff, paid taxes, followed regulations.

Now? Their shelves are being cleared out. Their investment is worthless. Their livelihoods are gone because lawmakers decided to burn the house down instead of fix a leaky pipe.

The result? More black-market sales. Less consumer safety. A court fight that’s already gearing up. And growing rage from Texans across the political spectrum.

What Now?

This isn’t the end of the fight. Legal challenges are coming. Advocates are organizing. The next legislative session is going to be a battleground—and voters will remember which lawmakers defended freedom and which ones caved to fear.

Rep. James Talarico stood up when it counted. The question is: will the rest of Texas?

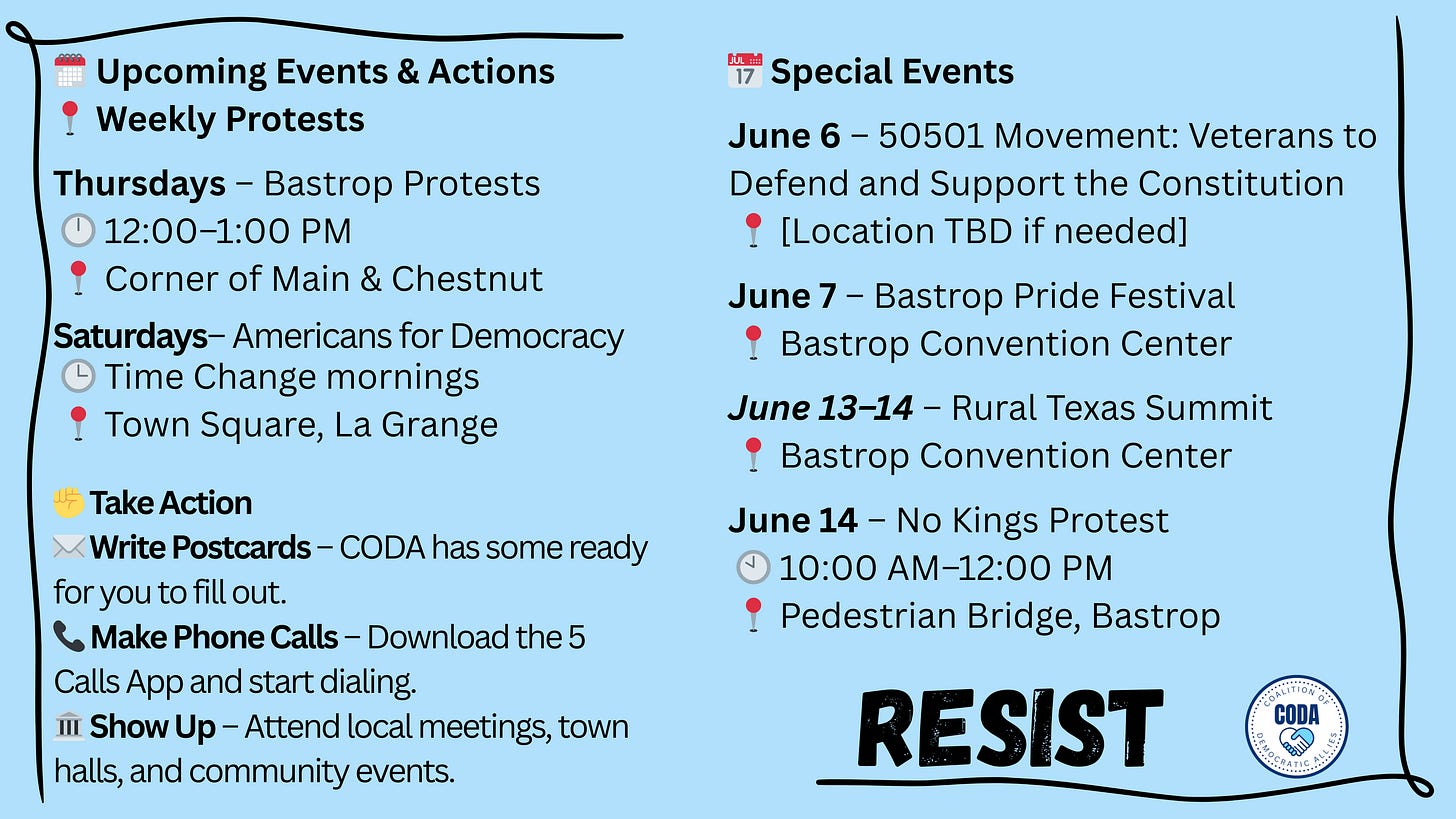

🔥2025 Rural Texas Summit — June 13–14 | Bastrop, TX

Where Rural Texans Make Noise, Gain Knowledge, and Take Action

Rural Texas is more than a political afterthought—it’s a battleground. Visit the Bastrop Convention Center for two days filled with meaningful discussions, strategic planning, and empowering rural communities. Don’t miss the Friday Night Festivities for an evening of fun, food, entertainment, and connection! Friday Panels start at 9:00 AM, Social Hour begins at 6:00 PM, followed by the Fundraiser/Dinner/Silent Auction at 7:00 PM. Saturday Panels run from 9:00 AM to 12:00 PM and 12:30 PM to 6:15 PM. Vendor /Sponsor Booths Friday Panels & Fundraiser Saturday Tickets Both Days

"One Big Beautiful Bill Act" (OBBBA): What It Does—and Who It Hurts

The House has passed a deeply polarizing bill with the charmingly Orwellian name: the One Big Beautiful Bill Act. But don’t let the name fool you—this bill’s beauty is in the eye of the billionaire. Here's a breakdown of what it actually does:

Key Provisions and Their Real-World Impact

🏦 Massive Tax Cuts for the Wealthy

Permanently extends Trump-era tax breaks for the top 1%.

Raises the State and Local Tax (SALT) deduction cap from $10,000 to $40,000 for upper-middle and high-income earners, disproportionately benefiting residents in high-tax blue states.

📉 Cuts to Medicare, Medicaid, and SNAP

Slashes over $1 trillion from Medicaid and food assistance (SNAP).

Introduces stricter work requirements, effectively pushing millions of Americans—often working poor—off basic health and food programs.

Estimated impact: 8.6 million could lose Medicaid coverage, 3 million fewer SNAP recipients.

👶 Child Tax Credit Gutted

Temporarily raises the Child Tax Credit to $2,500—but only for families where both the child and parent have Social Security Numbers.

Estimated 1 million children, mostly in immigrant families, now ineligible.

🚫 Children Over Age 7 No Longer Count as Dependents

Yes, you read that right. The bill redefines "dependent" status—and not in a good way.

Children over 7 are no longer automatically considered dependents for tax purposes.

Parents would now lose key tax benefits—including deductions and certain credits—for children ages 8 and older.

Why? Ostensibly to “simplify the tax code” and reduce government spending, but critics see it as a thinly veiled cut targeting middle- and low-income families.

💥 Impact:

A family with three kids over the age of 7 could lose thousands in tax breaks overnight.

Could reverse years of progress in reducing child poverty.

Effect on Seniors and Social Security Recipients

💸 No Direct Cuts to Social Security... But There’s a Catch

The bill doesn’t slash Social Security checks outright, but it tightens rules on how much retirees can earn without penalties.

Seniors who collect Social Security will now be taxed more heavily on any outside income, starting at just $12,000/year (down from $21,240 under previous law).

🧓 What This Means:

Seniors who take part-time work to stay afloat could see their benefits reduced and taxed simultaneously.

Coupled with cuts to Medicaid (which covers long-term care), older Americans face a financial squeeze from both ends.

Big Picture: Who Wins, Who Loses?

✅ Winners:

Billionaires, multinational corporations, and anyone with a yacht-sized SALT deduction.

❌ Losers:

Families with children over 7

Low-income earners (especially those making under $15K, who now face higher marginal tax rates)

Seniors on fixed incomes who take small jobs to survive

Medicaid and SNAP recipients—many of whom are the working poor

Final Thought

If you’re a hedge fund manager with no kids and a golf cart in your driveway, this bill might be your idea of “beautiful.” But if you're a working parent with three school-aged kids or a retiree working part-time at the grocery store, the One Big Beautiful Bill might feel more like a very ugly reality.

Actions:

Call your Senators and other Senators NOW and let them know that they can’t do this to the American workers and families.

House Passes Controversial 'One Big Beautiful Bill' Amidst Political Turmoil

The 'Big Beautiful Bill' is a big risk for House Republicans. Many of them hope otherwise. Today

Top Republicans threaten to block Trump's spending bill if national debt is not reduced Today